how much is renters credit on taxes

Married filing separate taxpayers are limited to a rent deduction equal to 50 of the rent each pays and cannot exceed 1500 per return. The renters property tax refund program sometimes called the renters credit is a state-paid refund that provides tax relief to renters.

If the space is being rented for both business and personal use.

. Vermont Department of Taxes. So if your tax liability is 0 the credit will basically do nothing for you. New York renters whose gross income is under 18000 can get a 75 credit if their rent is 450 or less and those over 65 can receive up to a 375 credit.

If your monthly rent is 1600 you can deduct 400 for your home office. In California renters who make less than a certain amount currently 41641. Avalara MyLodgeTax applies state and local taxes to your rental bookings automatically.

Use the calculator to estimate your Renter Credit. Ad All Major Tax Situations Are Supported for Free. Some states offer a tax credit tax deduction or property tax rebate for low-income renters.

For 2020 the California Renters Credit is 60. To claim a credit you may need to attach a rent. You or your spouseRDP were not given a property tax exemption during the tax year.

Plus if you have renters insurance you may also be eligible to deduct a portion of your premium. For questions about filing a renter credit claim contact us at. 60 credit if you are.

For questions about filing a renter credit claim contact us at. The average monthly rent you and other members of your household paid was 450 or less not counting charges. Tuesday January 18 2022 - 1200.

If you request an RPA by email only include the last four digits of Social Security Numbers. The final step is to calculate rental income tax. Ad Automate state and local taxes on rental properites so you can focus on guest experience.

Ad Automate state and local taxes on rental properites so you can focus on guest experience. You can find out if a property is service fee or tax exempt. Although it is nonrefundable the credit amount isnt that big.

You can however deduct expenses you incur to. However a married couple filing. State tax breaks for renters.

When you claim federal tax credits and deductions on your tax return you can change the amount of tax you owe. How Credits and Deductions Work. If you own an investment property and collect rent from your tenants its important to declare that rental income on your taxes.

120 credit if your are. The credit ranges between 3750 and 7500. In this example your taxable income would total 1037.

9 rows The amount of the renters tax credit will vary according to the relationship between the. Free means free and IRS e-file is included. Take the annual depreciation expense and multiply by 22 if married filing jointly.

The renters tax credit would give taxpayers a credit worth any amount in rent that they pay over 30 percent of their income paying more than 30 percent of your income in rent is. What is the renters property tax refund program. The Internal Revenue Service IRS does not give a federal tax credit to individuals paying rent for personal use.

2021 Renter Credit Website Calculator_8xlsx 5044 KB File Format. Mail the completed form to. Typically the deduction limit is set at 50 percent of the rent paid throughout the given tax year.

Max refund is guaranteed and 100 accurate. You or a member of your household paid rent for your residence. Here are the states that offer a renters tax credit for based on income.

The marginal tax bracket you are in of which there are 7 between 10 and 37 depends on your filing status and the amount of taxable income you report for the year. Therefore no matter how much rent is paid only 10 of the rent can be claimed for the homestead property tax credit. Avalara MyLodgeTax applies state and local taxes to your rental bookings automatically.

Start Your Tax Return Today. If youve lived in California for at least half of the year youre potentially eligible for a renters tax. Publication 524 Credit for the Elderly or the Disabled.

That being said each state has its own unique set of rules and we get into these specifics below.

Life Skills List For Young Adults In 2022 Credit Card Statement Life Skills List Of Skills

Low Income Renters Credit Hawaiʻi Tax Fairness Coalition

11 States That Give Renters A Tax Credit

Six Income Tax Deductions Most Hair Stylists And Barbers Overlook Pay Less Tax Shabby Chic Wall Decor Shabby Chic Bathroom Shabby Chic Living Room

Low Income Renters Credit Hawaiʻi Tax Fairness Coalition

California Renters Tax Credit May Increase To Up To 1 000

Cozy Helps Landlords And Tenants With Fast Credit Checks Background And Eviction Checks Free Online Rent Tenant Screening Being A Landlord Renters Insurance

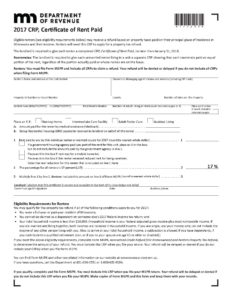

Crp Forms For Renters Credit Were Due To Tenants On 1 31 18 Home Line

The Importance Of Renter Insurance

Monthly Budget Planner Printable Filled And Blank Track Etsy Monthly Budget Planner Budgeting Budget Planner

5 Types Of Other Income That You Must Report On Your Taxes Income Tax Return Tax Services Income Tax

The Home Office Deduction Deduction Home Office Things To Sell

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

California Bill Would Boost Renter Tax Credit For First Time In 40 Years Kqed

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com